-

Market Review – March 1 2024

https://youtu.be/zCtKt4ms4eI https://finviz.com/ETF-sector-map

-

Stock Market Analysis February 2024

Stock Market Analysis February 2024 Add Your Heading Text Here

401k Funds Monitor

a new way to manage your 401k / 403b account

Our Business

Benefits for 401k plan participants

We are here and live

We have a focus on actively monitoring and overseeing funds in your 401(k)-employer sponsored retirement plan and we have CFP’s Certified Financial Planning professionals you can talk to if you like. We are aware many plans have no one you can call.

Tools and resources

We provide tools, services, and resources for you to keep track of your 401(k) investment options, monitor fund performance, receive alerts and recommendations. In our platform you will have everything you need to know, and much more.

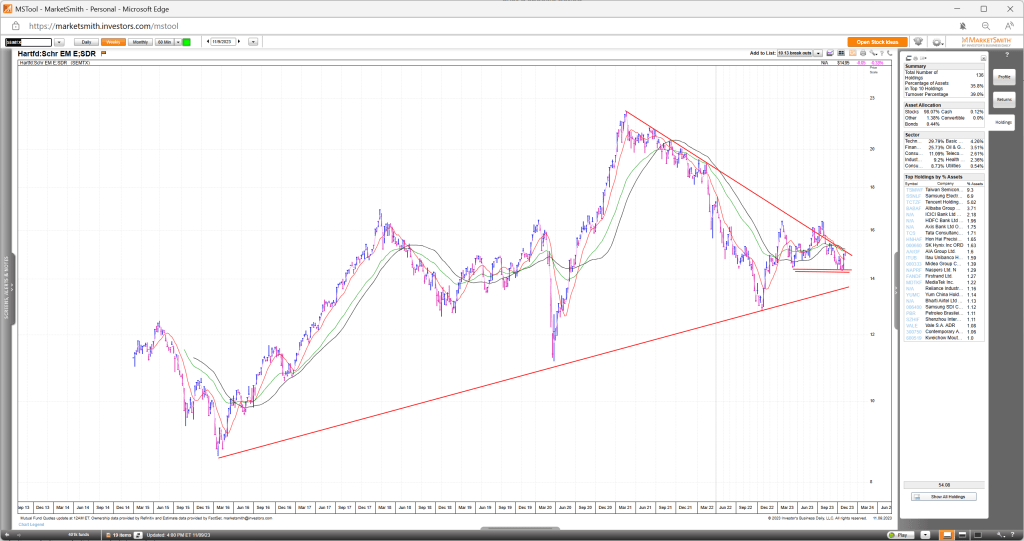

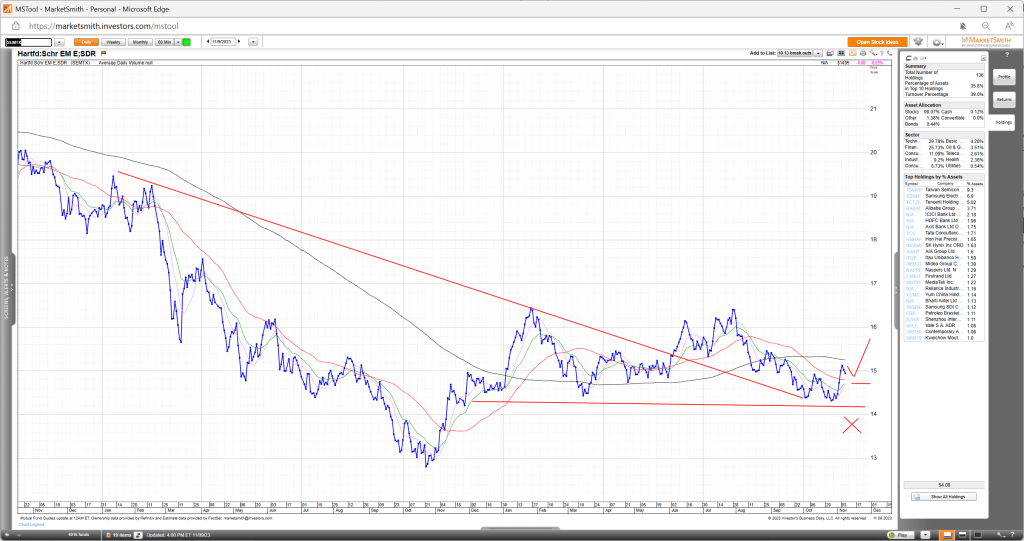

Chart = Thousand words

We are applying the idea that complex concepts like funds selection, performance and trend projections can be conveyed more effectively with one image than with a thousand-word opinion or description from any person. See more for sample .

Financial Planning

We help you understand how to maximize income tax advantages and employer matches while diversifying using informed investment decisions that will lead to make wise decisions, adapt to market changes achieve long-term financial goals and enjoyable retirement future.

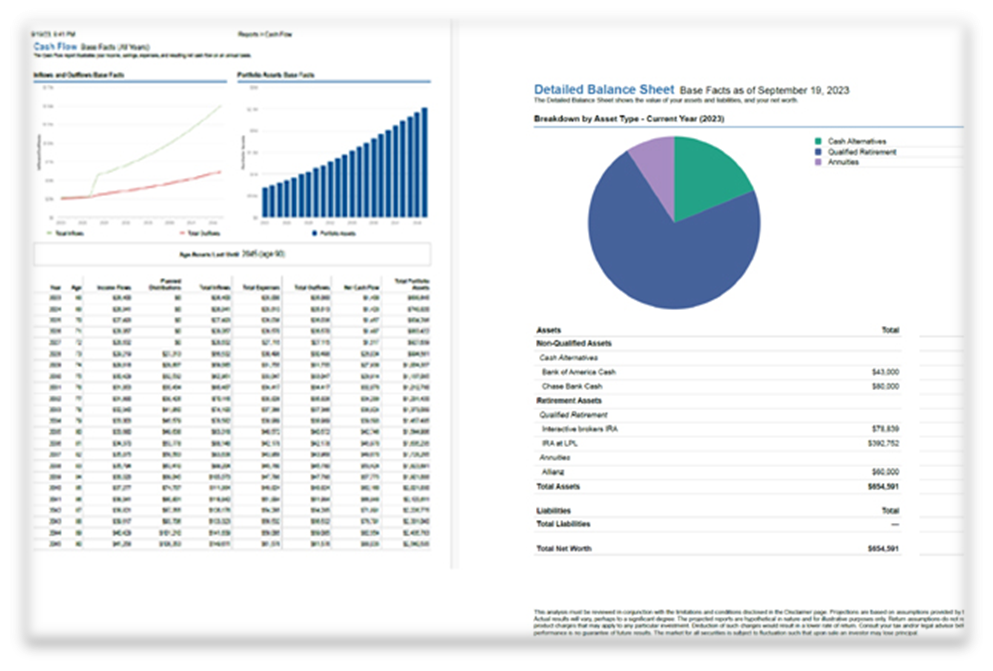

Financial Statements

Balance sheet, Income statements, and Cash-flow reports provide you a clear snapshot of your financial health, helping you track income, expenses, assets, and liabilities.

By analyzing these, you can make better decisions, and work towards financial long-term goals.

… and much more

Insurance planning is vital as it safeguards your financial future by protecting against unexpected events. We can run any quotes.

Estate planning is equally important, enabling you to structure your assets efficiently, ensuring a smooth transfer of wealth to heirs,

A game changer in the 401k and 403b plan services

“401k Funds Monitor has been a game-changer for my retirement planning as a busy physician. Their proactive approach in actively overseeing my 401(k) funds provided me with valuable insights and peace of mind. The tools and recommendations offered allowed me to make informed decisions about my investments, even in my hectic schedule.

Their personalized service and expert guidance ensured that I maximized my retirement savings efficiently. I highly recommend 401k Funds Monitor to any fellow healthcare professional looking for a reliable partner in securing their financial future.”

We Are Retirement Funds

Specialists

Real life case studies

Identify Winning Funds

You probably have aver 20 funds in your 401k plan and you are not sure where to start from. We will make that easy with the tools we have so you can pick the best funds for you..

Financial Planning Reports

If you can’t measure it you can’t manage. Let’s go and review several financial planning documents you need to understand if you are on the right track to secure and enjoyable retirement

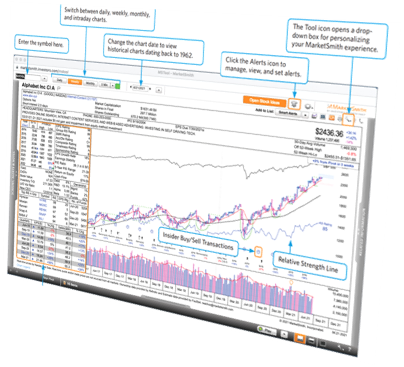

Funds chart analysis

Learning more about charts enables informed decision-making, helping you identify optimal entry and exit points, manage risks, and potentially maximize profits in the dynamic world of capital markets.

Meet Our Powerful Team

Why Choose Us ?

Choose us for unmatched expertise and personalized care in managing your 401(k) investments. With our 20 years of experience, we offer tailored solutions, in-depth knowledge, and a genuine commitment to your financial success, ensuring you make informed decisions and secure your future with confidence.

401k Funds Monitor has been a game-changer for my retirement planning as a busy physician.

Plelease Register for Free and download for Free the 401k Book!!!

Why choose us

Education Seminars

Educational videos on 401(k) topics simplify complex concepts, helping individuals understand crucial aspects such as contribution limits and investment options. These accessible resources promote financial literacy, empowering people to make informed decisions and optimize their retirement savings effectively.

Regular Market Reviews

Regular broad market video reviews provide concise updates on overall market trends, helping investors stay informed about key developments, stock performances, and economic indicators. These reviews serve as valuable tools for decision-making, enabling individuals to make timely investment choices based on current market conditions.

9/25/2023 – Market Review ->

Specific Funds and Stocks Analysis

Specific funds and stocks analysis videos offer in-depth insights into individual investment opportunities, providing detailed assessments of their performance, financial health, and market outlook. These videos empower investors to make well-informed decisions by offering comprehensive analyses of specific funds and stocks, helping them navigate the complexities of the market and optimize their investment strategies.

Who We Are

We are a team of experienced advisors dedicated to providing personalized 401(k) plan management, guiding employees through investment complexities, and ensuring confidence and peace of mind in their financial journey.

Our Vision

Our vision is to be the leading provider of proactive oversight and monitoring solutions, empowering individuals, plan admins and advisors with intuitive tools and expert resources to optimize investment choices, track fund performance, and receive timely recommendations, ensuring financial success and peace of mind.

Our Mission

Our Mission is to actively oversee and monitor 401(k) funds, enabling users to stay informed about their investment options, monitor fund performance, and receive timely alerts and recommendations, ensuring optimal financial decisions and a secure retirement future.

Step 1. – Get the list of your 403b Funds

Log in to provider website and get it online or if you don’t have list available you will be able to upload your statement and we will enter it for you.

Step 2. – Initial funds review based on performance

We will first list all the funds and their Year-to-Date performance.

We will also look the funds on shorter and longer-term basis.

Step 3. – Funds selection based on many factors

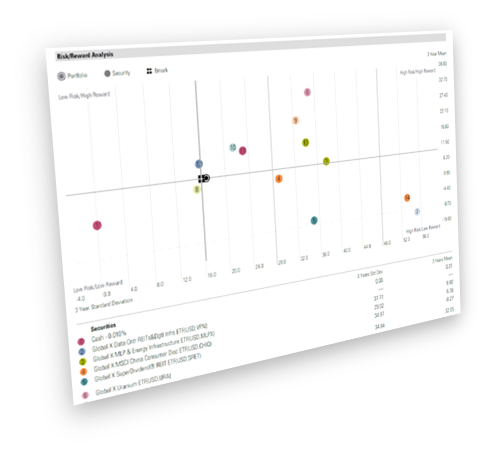

After reviewing all the funds based not only on relative performance, but all other parameters like Risk and Volatility, Funds cost, Sectors exposure, Geographical exposure etc, we will select the funds we believe should be in your first tier Asset allocation mix.

Funds Objective

A fund’s objective is a concise statement that outlines its purpose and investment goals, guiding how it aims to achieve returns for its investors within a specified time frame and risk tolerance.

Primary Benchmark

An investment fund’s benchmark is a specific index or performance measure used to assess the fund’s relative performance, providing investors with a basis for evaluating its returns against a comparable market standard.

Total Return

A gain or loss generated from its investments, typically expressed as a percentage, indicating the performance and growth of the fund’s assets over a specific period.

Picture is worth a thousand words.

After identifying the prospect funds, we will show you its Technical Chart

Only price pays

Here, we will disregard any Valuation based approach and only look at the price action of particular fund.

As indicated if it breaks down the support line it should be eliminated from the portfolio, and if it continues higher you should participate in it.

When to Buy and When to Sell

We will identify key support lines and trends we can set as parameters in our decision making if you should keep or get rid of this fund in your portfolio.

Upper chart: Long term – SEMTX on weekly view since 2015

Lower chart: Shorth Term – SEMTX on daily view since Nov 2021

From Our Blog